Fixtures And Fittings In Accounting . fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. in accountancy, the term ff & e is preferred. fixtures and fittings; Expenditure can only be classified as ppe when: fixtures and fittings refer to the movable items that are attached or installed in a building or property for use. what are furniture and fixtures? It is used in valuing, selling or liquidating a company or building,. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. It is probable (ie more likely than not) that future economic benefits associated with the item will flow to the entity; The cost of the item can be measured reliably. fixtures and fittings or leasehold improvements. Furniture and fixtures are larger items of movable equipment that are used.

from www.chegg.com

Expenditure can only be classified as ppe when: fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. fixtures and fittings refer to the movable items that are attached or installed in a building or property for use. Furniture and fixtures are larger items of movable equipment that are used. fixtures and fittings or leasehold improvements. It is probable (ie more likely than not) that future economic benefits associated with the item will flow to the entity; The cost of the item can be measured reliably. fixtures and fittings; It is used in valuing, selling or liquidating a company or building,.

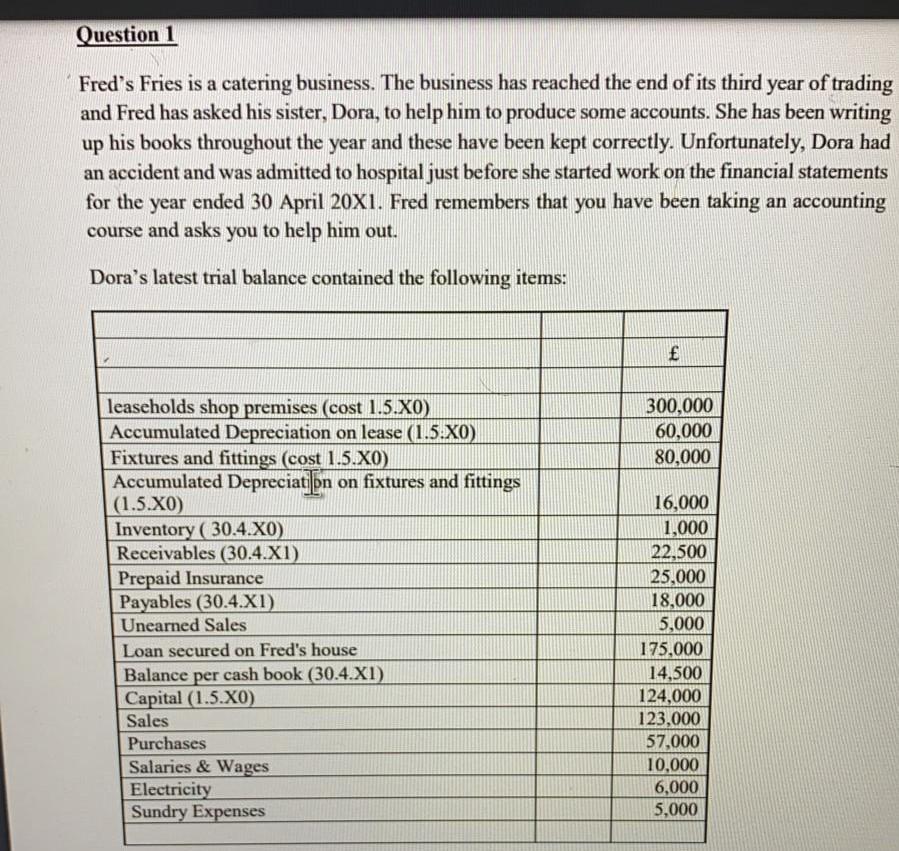

Solved 1. Fixtures and fittings which cost £12,000 with

Fixtures And Fittings In Accounting fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. in accountancy, the term ff & e is preferred. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. fixtures and fittings; It is used in valuing, selling or liquidating a company or building,. what are furniture and fixtures? The cost of the item can be measured reliably. Furniture and fixtures are larger items of movable equipment that are used. fixtures and fittings or leasehold improvements. Expenditure can only be classified as ppe when: It is probable (ie more likely than not) that future economic benefits associated with the item will flow to the entity; fixtures and fittings refer to the movable items that are attached or installed in a building or property for use. fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and.

From ceblzisc.blob.core.windows.net

Furniture And Fixtures Difference at Michael Lawless blog Fixtures And Fittings In Accounting what are furniture and fixtures? It is probable (ie more likely than not) that future economic benefits associated with the item will flow to the entity; in accountancy, the term ff & e is preferred. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. It is used in valuing,. Fixtures And Fittings In Accounting.

From www.chegg.com

Solved 1. Fixtures and fittings which cost £12,000 with Fixtures And Fittings In Accounting fixtures and fittings or leasehold improvements. Expenditure can only be classified as ppe when: in accountancy, the term ff & e is preferred. fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. fixtures and fittings refer. Fixtures And Fittings In Accounting.

From perfectfitusa.biz

Equipment Fixture Schedules Perfect Fit USA Fixtures And Fittings In Accounting Expenditure can only be classified as ppe when: It is used in valuing, selling or liquidating a company or building,. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. Furniture and fixtures are larger items of movable equipment that are used. in accountancy, the term ff & e is preferred.. Fixtures And Fittings In Accounting.

From www.studocu.com

ACC 117 Chapter 3 TUTORIALCHAPTER 3 ACCOUNTING EQUATION Fixtures And Fittings In Accounting Furniture and fixtures are larger items of movable equipment that are used. fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are.. Fixtures And Fittings In Accounting.

From learningferrandzu.z21.web.core.windows.net

Printable Debits And Credits Cheat Sheet Fixtures And Fittings In Accounting furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. fixtures and fittings or leasehold improvements. The cost of the item can be measured reliably. fixtures and fittings; fixtures and fittings refer to the movable items that are attached or installed in a building or property for use. . Fixtures And Fittings In Accounting.

From www.studocu.com

T1 Double entries Tutorial Questions (Topic 1) Identify each of the Fixtures And Fittings In Accounting fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. Expenditure can only be classified as ppe when: in accountancy, the. Fixtures And Fittings In Accounting.

From accountingexplained.wordpress.com

Statement of Financial Position (Balance Sheet) accountingexplained Fixtures And Fittings In Accounting It is used in valuing, selling or liquidating a company or building,. fixtures and fittings; The cost of the item can be measured reliably. fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. Expenditure can only be classified. Fixtures And Fittings In Accounting.

From www.signnow.com

Fixtures and Fittings List Template Edit & Share airSlate SignNow Fixtures And Fittings In Accounting Expenditure can only be classified as ppe when: Furniture and fixtures are larger items of movable equipment that are used. fixtures and fittings refer to the movable items that are attached or installed in a building or property for use. what are furniture and fixtures? in accountancy, the term ff & e is preferred. fixtures and. Fixtures And Fittings In Accounting.

From lucillekruwramsey.blogspot.com

Fixtures and Fittings Accounting LucillekruwRamsey Fixtures And Fittings In Accounting fixtures and fittings refer to the movable items that are attached or installed in a building or property for use. fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. furniture, fixtures, and equipment (ff&e) are items that. Fixtures And Fittings In Accounting.

From studylib.net

Fixtures and Fittings Fixtures And Fittings In Accounting fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. It is probable (ie more likely than not) that future economic benefits. Fixtures And Fittings In Accounting.

From d38d52hpv5531h.cloudfront.net

What Is Fixtures And Fittings In Accounting at Mary Remillard Blog Fixtures And Fittings In Accounting Expenditure can only be classified as ppe when: It is probable (ie more likely than not) that future economic benefits associated with the item will flow to the entity; Furniture and fixtures are larger items of movable equipment that are used. fixtures and fittings refer to the movable items that are attached or installed in a building or property. Fixtures And Fittings In Accounting.

From shaniyatehodge.blogspot.com

Fixtures and Fittings Accounting ShaniyateHodge Fixtures And Fittings In Accounting fixtures and fittings refer to the movable items that are attached or installed in a building or property for use. It is used in valuing, selling or liquidating a company or building,. furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. what are furniture and fixtures? fixtures and. Fixtures And Fittings In Accounting.

From www.rgis.co.uk

Fixture and Fittings Survey Including Department Stocktake RGIS Fixtures And Fittings In Accounting It is used in valuing, selling or liquidating a company or building,. fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. fixtures and fittings; furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to. Fixtures And Fittings In Accounting.

From exorzoqak.blob.core.windows.net

What Is Material Information In Accounting at Edward Hardy blog Fixtures And Fittings In Accounting fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. what are furniture and fixtures? in accountancy, the term ff & e is preferred. fixtures and fittings refer to the movable items that are attached or installed. Fixtures And Fittings In Accounting.

From differencebtw.com

Fixtures vs. Fittings Know the Difference Fixtures And Fittings In Accounting The cost of the item can be measured reliably. fixtures and fittings; It is probable (ie more likely than not) that future economic benefits associated with the item will flow to the entity; furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. fixtures and fittings cost (expense type) if. Fixtures And Fittings In Accounting.

From www.nationalpropertybuyers.co.uk

What is Fittings and Contents Form TA10? Fixtures And Fittings In Accounting what are furniture and fixtures? It is probable (ie more likely than not) that future economic benefits associated with the item will flow to the entity; Furniture and fixtures are larger items of movable equipment that are used. The cost of the item can be measured reliably. fixtures and fittings or leasehold improvements. fixtures and fittings cost. Fixtures And Fittings In Accounting.

From teachsa.co.za

i. Financial accounting of a sole trader TeachSA Fixtures And Fittings In Accounting what are furniture and fixtures? Expenditure can only be classified as ppe when: furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are. It is used in valuing, selling or liquidating a company or building,. fixtures and fittings; fixtures and fittings or leasehold improvements. fixtures and fittings cost. Fixtures And Fittings In Accounting.

From civiconcepts.com

Office Equipment List And Their Uses Fixtures And Fittings In Accounting fixtures and fittings cost (expense type) if you have a home office, or space you rent to work from, you’re likely to need to purchase some office furniture and. The cost of the item can be measured reliably. Furniture and fixtures are larger items of movable equipment that are used. fixtures and fittings refer to the movable items. Fixtures And Fittings In Accounting.